Q. What is EDGE Mile?

A. EDGE Mile is an online platform developed by Edge AI, Inc. that helps businesses, organizations, and individuals to better manage and measure the performance of their operations. It provides an easy-to-use dashboard with customizable metrics and analytics to help users understand, monitor, and improve their performance. It also provides detailed insights into customer behavior and trends, and offers actionable recommendations to help improve operations. Additionally, EDGE Mile offers a library of resources and helpful tools to further support performance management.

Q. What is the difference between EDGE MILE and EDGE Point?

A. EDGE Mile is a rewards program that allows customers to earn points when they purchase products and services from participating merchants. EDGE Point is a loyalty program that allows customers to earn and redeem points for rewards such as discounts, gifts, and more. EDGE Mile is focused on rewarding customers for their frequent purchases while EDGE Point is focused on rewarding customers for their loyalty.

Q. How can EDGE Miles be redeemed?

A. EDGE Miles can be redeemed for a variety of rewards, including free flights, hotel stays, rental cars, and more. You can also use them to upgrade your flight or purchase additional amenities such as airport lounge access and priority boarding.

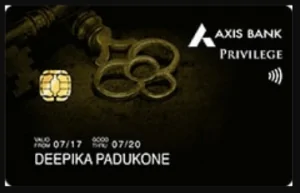

Q. What is the foreign transaction fee charged by Axis Bank Atlas credit card?

A. The foreign transaction fee charged by Axis Bank Atlas credit card is 3.50%.

Q. I don't have a bank account. Can I apply for an Axis Bank Atlas credit card?

A. No, you cannot apply for an Axis Bank Atlas credit card without having a valid bank account.